When it comes time to making decisions about college, understanding how much an education costs can be one of the most confusing — but important — components. Many factors go into the final cost of a college education, including major, the college of choice, location, public versus private, room and board and so on. Not only can paying for an education be difficult, but it can also be difficult to warrant spending this money on an undecided career path. Many students find themselves overwhelmed with unanswered questions about financing their college education.

In this article, we’ll break down some things to consider when trying to more clearly understand what an education really costs. In addition, we'll provide a few resources and tools to guide major and career exploration that aligns with goals, including salary, location, employer and more.

1. How to calculate tuition based on circumstance

Tuition costs vary for every student depending on the type of institution (public or private), residency status (many colleges and universities have lower tuition costs for residents of the states in which they reside) and inflation, along with other changes to the economy.

According to College Board, "Between 1991-92 and 2021-22, the average tuition and fees increased from $2,310 to $3,800 at public two-year, from $4,160 to $10,740 at public four-year and from $19,360 to $38,070 at private nonprofit four-year institutions, after adjusting for inflation."

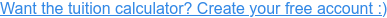

The question becomes, how do you calculate tuition based on personal circumstance and financial situation versus a broad estimate found online? The Digital Career Counselor offers a Tuition Analyzer that factors in tuition costs, loan costs, inflation, time value of money and expected earnings for a financial analysis tailored to the student. Students can even compare costs across universities, which is particularly useful for those in the decision stage. This opportunity allows the user to plug in the names of any colleges in consideration.

Within the tuition tool, students can dynamically adjust the interest rate, loan amount or term to learn the actual cost of college rather than just the sticker price. This functionality gamifies the complex interaction between the three inputs and increases the opportunity for engagement and impact.

Within the tuition tool, students can dynamically adjust the interest rate, loan amount or term to learn the actual cost of college rather than just the sticker price. This functionality gamifies the complex interaction between the three inputs and increases the opportunity for engagement and impact.

The breakeven analysis inside the tool gives students a tangible period for how long it will take to recover from the education investment and expected earnings post-graduation, based on their expected career. Students can switch between various schools, debt terms and careers to find the optimal combination.

Create a free account here to try the Tuition Analyzer now.

2. How to predict payback potential

The best way to predict earnings after graduation is to examine the career outcomes of real people. The Digital Career Counselor offers two ways to do this. The Outcomes module allows students to view real outcomes for any degree at any educational institution to learn salaries, top employers, common positions and even the exact skills those alumni possess. The Search 360 module offers advanced analytics on education requirements by job title and detailed salary progression information over time.

3. Don't forget school supplies, equipment

When analyzing tuition costs, remember this number is only part of the total. Other things to consider include supplies, transportation, housing, meal plans, sorority or fraternity fees and, of course, textbooks. Since 1978, textbook prices have risen 812 percent meaning a $25 textbook then would cost $203 today. Read more on that in this report by Follett.

According to CollegeData, the average cost in 2021-22 for books and school supplies at both public and private colleges is $1,240. Some equipment is required, like laptops, calculators and materials dependent on major, and other supplies are optional and should be prioritized.

Before the first day of class each semester, students should stock up on both required and optional items. For dorm rooms, sheets, towels, lamps, cleaning supplies, a microwave and a mini-fridge are recommended purchases. Many students neglect to factor living expenses such as these into the total cost of college creating an inaccurate budget to plan for.

4. Understand how fees are allocated

While some schools combine tuition and fees into one lump number, others have separate charges for tuition and associated fees. While tuition is the amount of money spent on the actual instruction, fees are additional costs that cover recreation centers, libraries, health centers, laboratories, extracurricular activities and even parking. Being financially responsible means paying attention to the details, and it's important to budget for these less obvious charges.

5. Room and board isn't one-size-fits-all

Room and board is another expense that varies from school to school. It also varies from student to student. Some students choose to live in on-campus dormitories for the true college experience. But others may choose to live in an on-campus house or apartment with roommates. Of course, each living arrangement has its unique costs. Many students choose to attend local colleges that are close enough to commute from home.

If students are borrowing money to cover room and board, they can include the cost when calculating tuition using tools like the Digital Career Counselor. The Loan Amortization Schedule gives students an idea of the future monthly payment required for the term of the loan for a more clear projection of financial health.

6. Paying for college with a little help

After analyzing estimates on how much an education will actually cost, it's normal to feel overwhelmed. Many Americans struggle with paying for college. The good news is that there are financial assistance options and student loans available to help make college achievable for anyone. The financial aid office is a great place to start.

Students already holding several college loans should consider looking at student loan refinance rates from some of the top lenders. Here, students can learn more about how to refinance student loans and check out some of the best student loan refinance rates.

Although grasping what an education will cost is difficult, remember that choosing a college and career path is one of the most important financial decisions a student will ever make. It's also important to remember there are resources and tools to help. The links provided throughout this guide are designed to support a better understanding of what an education really costs, as well as introduce concepts for proactive financial well-being.

%20(1).png)

.png)